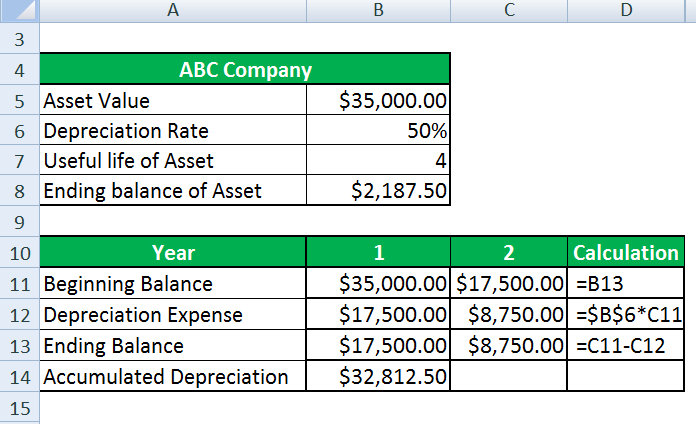

Diminishing value depreciation example

The cost includes the amount you paid for the asset excluding GST if entitled to claim it as well as any. The difference in the value of accounting depreciation and economic depreciation should be adjusted from the capital employed.

Straight Line Vs Reducing Balance Depreciation Youtube

Base value 6000 x 40 claimable amount 2400.

. The book value of asset gradually reduces on account of charging depreciation. That means you get the biggest tax write-offs in the years right after youve. Depreciation charge per year net book value residual value x depreciation factor.

Given Variable cost per unit 20. These are expenses that do not affect the cash flow of a given period. Using this information the reducing balance method calculates depreciation in two steps.

Base value 10000 x 40 claimable amount. Declining Balance Method. According to Reducing Balance Method the percentage at which depreciation is charged remains fixed and the amount of depreciation goes on diminishing year after year.

The calculation of depreciation. It is calculated by subtracting accumulated. For example if the asset cost you 10000 you purchased it on July 1 and its effective life was five years the following equation would apply.

Let us take the simple example of the manufacturing plant of ASF Inc where the total fixed cost of production during the year was 100000 and the variable cost of production was 20 per unit. Includes formulas example depreciation schedule and partial year calculations. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance.

To calculate depreciation you can generally use either the prime cost method or the diminishing value method. For example 2 is 200 05 is 50. Depreciation Expense Book value of asset at beginning of the.

With the double declining balance method you depreciate less and less of an assets value over time. Diminishing balance depreciation with residual value. Written-down value is the value of an asset after accounting for depreciation or amortization and it is also called book value or net book value.

For subsequent years the base value will reduce based on the difference between the current year and the next year. The depreciation is calculated using the diminishing. In some cases you must use the same method used by the former holder of the asset for example if you acquire the asset from an associate such as your spouse or business partner.

Since the depreciation rate per cent is applied on reducing balance of asset this method is called reducing balance method or diminishing balance method. The depreciable cost of motor vehicle is subject to the Luxury Car Limits which assumes an upper limit on the cost on which depreciation is calculatedIf the vehicle costs more than the limit depreciation is only. Base value 3600 x 40 claimable amount 1440.

To calculate depreciation for most assets for a particular income year you can use the Depreciation and capital allowances tool. Using our example from step 2 your commercial espresso machines adjusted tax value is 7000 with a diminishing value rate of 30. One such measure is the reintroduction of tax depreciation on non-residential commercial and industrial buildings and the allowance for tax depreciation on newly acquired buildings and capital improvements made to existing buildings from the 202021 tax year.

Diminishing Value Depreciation Method. The book value of an asset is obtained by deducting depreciation from its cost. If the asset cost 80000 and has an effective life of five years the claim for the first year will be.

Entity purchased for 12 million an item of high-tech PPE subject to increased technical obsolescence. Next determine the average cost of production if the company manufactured 20000 units during the year. Calculator for depreciation at a declining balance factor of 2 200 of straight line.

In generic term depreciation is the decrease in value. For assets that use a diminishing value method Oracle Assets depreciates the remaining fraction of the assets net book value as of the beginning of the fiscal year. Foreign exchange contracts are reported at fair value as on the reporting date.

Depreciation for Reinstatements The retirement convention date retired and period in which you reinstate an asset control how much depreciation Oracle Assets calculates when you reinstate an asset. Washington Brown Quantity Surveyors are experts in property tax depreciation for investment properties. The tax depreciation rate will be 15 straight line or 2 diminishing value.

We have a specialist commercial property depreciation team solely dedicated to. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. The entity assesses that the asset will be used for 5 years with most of its performance utilised in the first years.

Reducing Balance Method Formula. An example of Depreciation. Work out the depreciation like this.

Double declining balance depreciation isnt a tongue twister invented by bored IRS employeesits a smart way to save money up front on business expenses. In order to maximise the tax savings on your investment property youll need a professionally prepared Tax Depreciation Report or Tax Depreciation Schedule. You use it 100 for business for the full year so do not need to work out business use percentage or months used.

The residual value is 2 million. Calculate the depreciation charge using the following formula. In this example the base value for the second year of the asset will be 40000 ie.

Car Depreciation Cost Limit. If an asset costs 50000 and has an effective life of 10 years your first years deduction will be. Assets acquired since 10 May 2006 may use a diminishing value rate equivalent to double the prime cost rate.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

Choosing Depreciation Methods Diminishing Value Vs Prime Cost

Method To Get Straight Line Depreciation Formula Bench Accounting

Written Down Value Method Importance Of Written Down Value Method

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Written Down Value Method Of Depreciation Calculation

Rate Adjustments Diminishing Value Depreciation Method Oracle Assets Help